Kingdom of Opportunities: How to setup your business in KSA

Back in 1930s in the Eastern Province of Saudi Arabia when American Geologist Max Steineke ordered the drilling of the seventh deep-test well despite dis-satisfactory results from the previous six oil wells, nobody could have imagined the commercial success and glory that the lucky 'Dammam no. 7' well would bring to the Saudi economy; similarly today, almost a century later, when the world had written off Saudi economy’s survival without oil, the Saudi leadership has stunned everyone with its galvanizing and ginormous plans to diversify its economic resources and craft out a ‘vision’ for the future where oil wouldn’t play a dominant role. This vision makes the Kingdom one of the most exciting places to set up your business.

Source: Arab News: Saudi Arabia's non-oil economy grows at fastest pace in 6 years, 2020

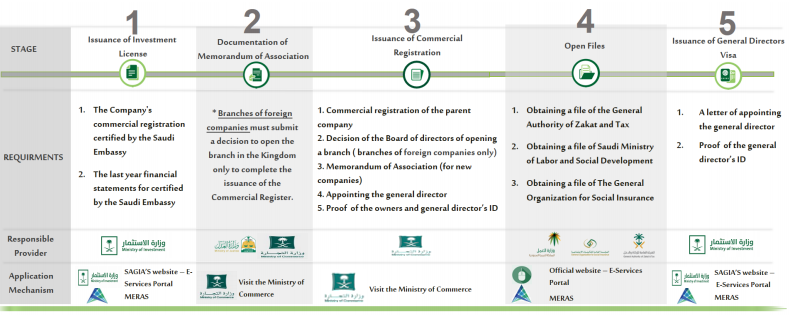

Not only is Saudi Arabia the largest economy in the Arab world, but with a GDP of $792.97 Billion in 2019 according to the World Bank, it is also among the top 20 economies globally. Earlier in March this year, Arab News reported that Saudi Arabia’s non-oil economy grew by 3.3% last year, its fastest pace since 2014, and most of the output was driven by increased private consumption and investment in retail, financial and hotel sectors. However, it would be credulous to not acknowledge the impact of COVID-19 - the biggest disruptor of the year (if not of the century) – on the topography of the current economy. Saudi Arabia has spent $57 Billion, thus far, on various initiatives designed to mitigate the impact of COVID-19 on the public and private sectors. The Saudi Arabian Monetary Authority (SAMA) reduced its policy rates while the General Organization for Social Insurance (GOSI) supported the private sector tremendously by covering 60% of salaries for Saudi individuals who faced uncertainty due to the pandemic. As we write this post, the number of COVID-19 cases in KSA that had peaked with 5000+ a day in mid-June, are now declining and the multiple 24-hour lock-downs that the country faced to curb the spread of the virus are long gone. The focus of the government and policymakers, globally as well as locally, is now shifting towards the crucial role of private sector and SMEs. The Saudi government is confident of the contribution of the private sector in strengthening the economy and is keen to attract investors from all over the world once international flights resume and business travel commences again. While Saudi Arabia may seem daunting to foreign investors, today the Saudi government has made it very flexible for businesses and MNCs to establish themselves in Saudi. Saudi Arabia’s commitment to attracting quality foreign investments is evident from the setup of a separate ministry to provide a seamless process for the establishment of foreign businesses. Ministry of Investment of Saudi Arabia (MISA): Previously known as Saudi Arabian General Investment Authority (SAGIA), MISA offers advisory services, market research and insights as well as one-stop-shop business centers providing services from the Ministry along with the following government entities: Ministry of Commerce General Authority of Zakat & Tax Ministry of Labor & Social Development Ministry of Justice Passport General Department Chamber of Commerce Through the Meras portal under MISA you can receive your investor license within one day. Meras is currently being developed under multiple phases to include all types of services that facilitate setup and management of businesses. The Meras website lists out all the activities that require licenses from different ministries as well as an exhaustive list of activities that require no licenses. Initially "The Negative List" – sectors where foreigners can't invest – was quite comprehensive but now is limited to oil exploration, drilling and production, along with military and security sectors, real estate in Holy cities of Makkah and Madinah, tourist services related to Hajj and Umrah and few more. There are various simple stages involved in setting up your business in KSA:

Source: MISA Services Manual, 2020

STAGE 1: Type of entity: According to MISA's Services Manual 2020, you can decide on either of the options: 100% Foreign Commercial License/LLC: This route is especially open for entities looking to deal with retail trade, eCommerce and whole sale within KSA. Companies are expected to have a presence in at least 3 other regional or international markets and must make an investment of SAR 300 Million over the course of their first five years including SAR 30 Million as the cash capital for the company. Furthermore, 30% of the company's products distributed locally should be manufactured within KSA, 5% of total sales should be directed at R&D programs in the Kingdom, and there is a requirement of a unified center to manage logistics, distribution and after-sales services. Commercial with Saudi Partner: Through this route, investors can gain access to the Saudi market with a Saudi partner and thus benefit from a stronger footing in the country. According to MISA, the Saudi shareholder needs to have at least 25% share of the company. Minimum investment is SAR 26.6 Million including SAR 20 Million as the cash capital for the company. Joint Stock Company (JSC): The minimal capital requirement for a joint stock company with more than one individual is SAR 500,000; whereas that of a company with an individual is SAR 5,000,000 with no Saudi partners required in either set-up. Companies can also choose to set-up a branch of their company in KSA which is mentioned in

STAGE 2 of the infographic.

STAGE 3 & 4: Completing the registration process: After foreign entities have been successfully issued their investment license; they need to register with the Ministry of Commerce for issuance of Commercial Registration. And then proceed to open files with the following government entities: Chamber of Commerce Ministry of Justice General Authority of Zakat & Tax The Municipality Ministry of HR & Social Development General Organization for Social Insurance Foreign businesses must adhere to the localization quotas of hiring Saudis as determined by the Ministry of Human Resource & Social Development's Nitaqat grading program.

STAGE 5: Visas & Iqamas: All services for IDs, documentation and work permits are available online which can be handled by a company's GRO – Government Relations Officer. Renewals of iqama, dependent iqamas, exit re-entry can be done without visiting offices via the GOSI and Absher portals. Business visit visas can be issued via the Ministry of Foreign Affairs. Foreign companies can focus on generating revenues and not get caught up in endless paperwork.

'VAT' happened? As of 1st July, 2020, the previously at 5% VAT in the Kingdom of Saudi Arabia has been tripled to 15%.

Corporate Tax: Although corporate income tax is levied only on non-GCC foreign investors, there are some taxes levied on the business that are all filed with the General Authority of Zakat & Tax. It’s crucial to highlight that the government has created tax exemptions in the following economic cities around the Kingdom to promote their development: Hail Jazan Najran Al Baha Al Jouf Northern Territory

Legal Support: Though the journey of setting up a business is apparently straightforward, there might be certain obstacles that will require legal support.

MISA provides a range of legal support services such as: Rights of Applicant of Issuance of New Investment License Rights of Foreign Investor throughout License Term Rights of Foreign Investor after License Cancellation Various judicial authorities and quasi-judicial committees have also been appointed to hear legal disputes and lawsuits such as District Courts, General Courts, Administrative Courts, Commercial Courts, Executive Courts and other committees. We hope the above gives you a brief overview of the process of establishing your business in KSA. With KSA’s ‘Vision 2030’, the current leadership aims at enhancing the Kingdom’s positioning as an investment powerhouse, to diversify the economy and develop the health, education, recreation and tourism sectors. With such tremendous support from the government, Saudi is definitely the next hotspot to establish your business!

TASC Outsourcing has a Riyadh office and falls under the platinum category of the Nitaqat program. We are committed to supporting the Saudi government’s Vision 2030 by providing locally based businesses with Saudi & global talent through contract staffing, permanent recruitment, remote worker solutions and on-demand hiring. TASC also provides PEO, Payroll Outsourcing and PRO/GRO services to support businesses so they can focus on generating revenue. The author of this article is Melvyn Masarenhas, VP at TASC Outsourcing. He can be reached at melvyn@tascoutsourcing.com